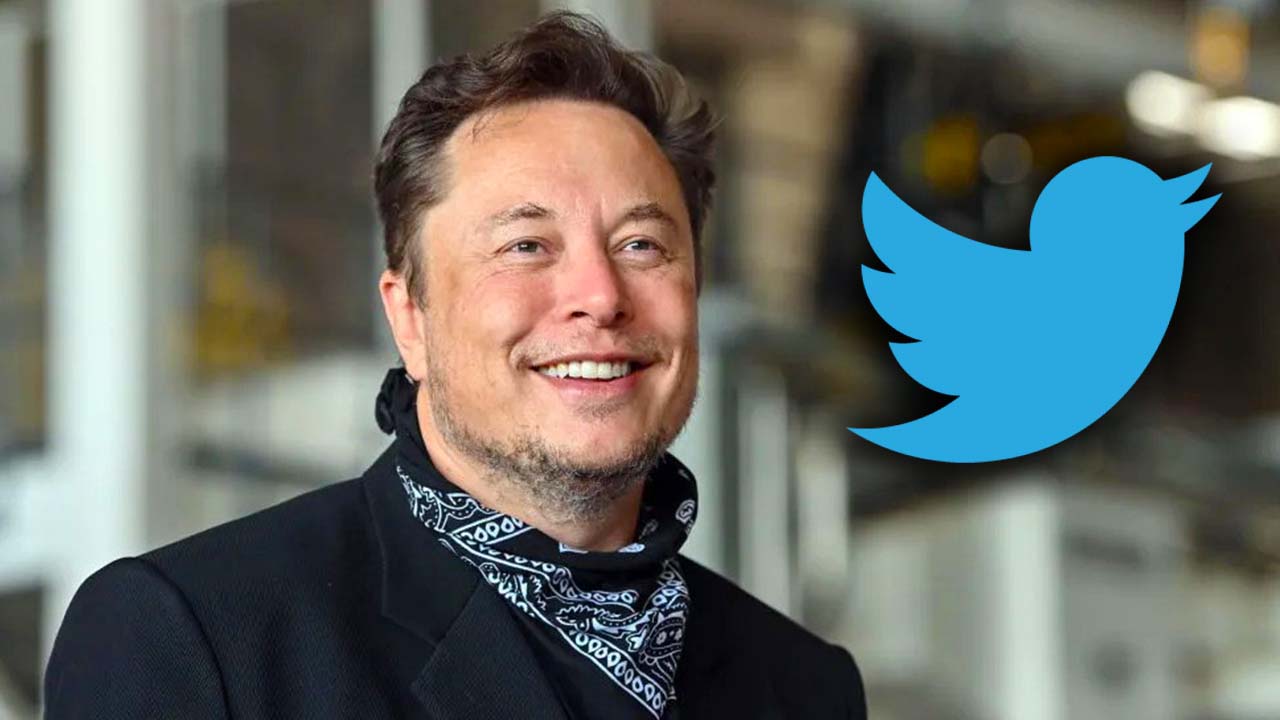

Elon Musk has submitted a takeover bid for Twitter, offering $54.20 per share, days after becoming the group’s largest shareholder. This is an offer worth more than $43 billion.

According to a Securities and Exchange Commission (SEC) filing, Mr. Musk described this as a “best and last offer,” reflecting a 54 per cent premium over the day before he commenced investing in the business in late January 2022.

Musk stated in the filing that “I don’t have faith in the management” and that he could not make the adjustments he desired in the public market.

I made an offer https://t.co/VvreuPMeLu

— Elon Musk (@elonmusk) April 14, 2022

As per a letter written to CEO Salesforce and chairman of Twitter, Bret Taylor, Musk stated that if the proposal is not accepted, he will reassess his status as a shareholder as Twitter has a lot of potential which needs to be unlocked.

The billionaire CEO of Tesla and SpaceX and the world’s richest man, purchased a 9.2 per cent share in Twitter on April 4, according to a regulatory filing. The tech mogul was invited to join Twitter’s board of directors the next day, but he denied the offer by the end of the week.

Musk wrote to Mr. Taylor on April 13: “I invested in Twitter because I believe it has the potential to be the global platform for free speech, and I believe free speech is a societal requirement for a healthy democracy”.

Read more: Elon Musk is no longer joining Twitter board as the microblogging network is “dying”

“However, after making my investment, I’ve come to recognize that the company, in its current form, can neither thrive nor serve this societal need,” he wrote. “Twitter should be turned into a private firm”.

Considering the tweeted document, Musk’s financial adviser for the proposal is Morgan Stanley.