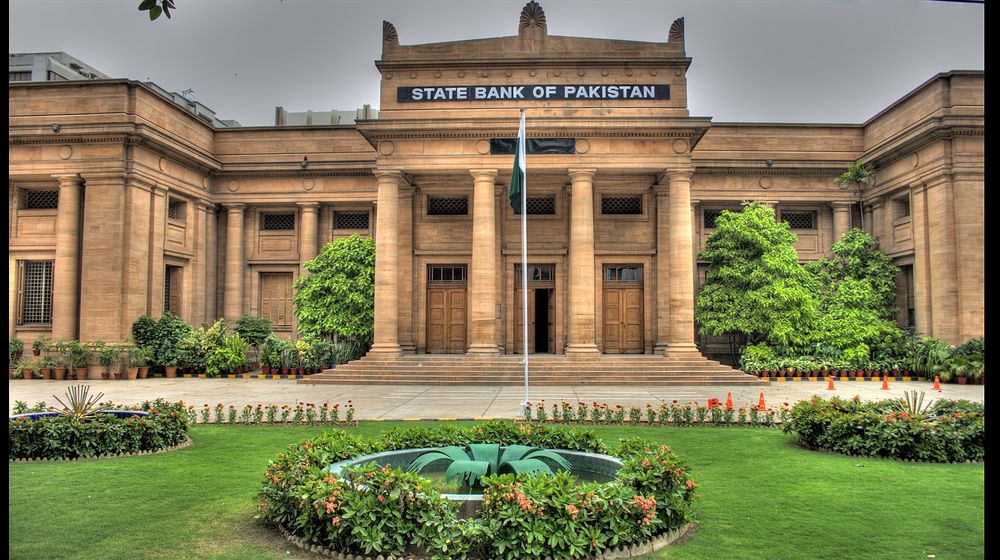

Foreign direct investment (FDI) fell by 30 per cent in the first half of the current fiscal year (H1FY21), according to data released by the State Bank of Pakistan (SBP).

According to a report based on the data compiled by a local media outlet, Pakistan received $952 million in foreign investment during July-December FY21 compared to $1.357 billion in the corresponding period last year.

In addition to the damage done by the pandemic, the impact of heavy outflow from the portfolio also played a key role in making the balance sheet poorer in the first half of FY21. The data shows that the outflow during July-December was $244m compared to a net inflow of $18.8m in the same period last year.

The breakup further shows that China made 38pc contribution to the overall $952m FDI the country received in July-December period of FY21. However, the FDI inflows from China also contracted to $359m in the period under review compared to $396m in the same period of last fiscal year.

The other significant contributions were from the United States and UK at $65m and $63m, respectively, both improved from $44m and $58m in the same period of last fiscal year. The United Arab Emirates (UAE) has started disinvesting; however, in July-December FY21, the inflow was $16.3m.

The country received the highest foreign investment of $261m in electricity, gas, steam and air conditioning supply sectors. While an inflow of $137m was noted in financial and insurance sectors.