In the intra-day trade on Friday, the Pakistani rupee (PKR) gained an impressive Rs3.5 against the US dollar, the highest single-day gain in two years after the Supreme Court (SC) pronounced the National Assembly (NA) deputy speaker order unconstitutional and restored the NA.

The US dollar is currently trading at Rs185, as per foreign currency dealers, after weakening Rs3.5 versus the local currency in early trade. The USD is currently trading for above Rs186 on the open market.

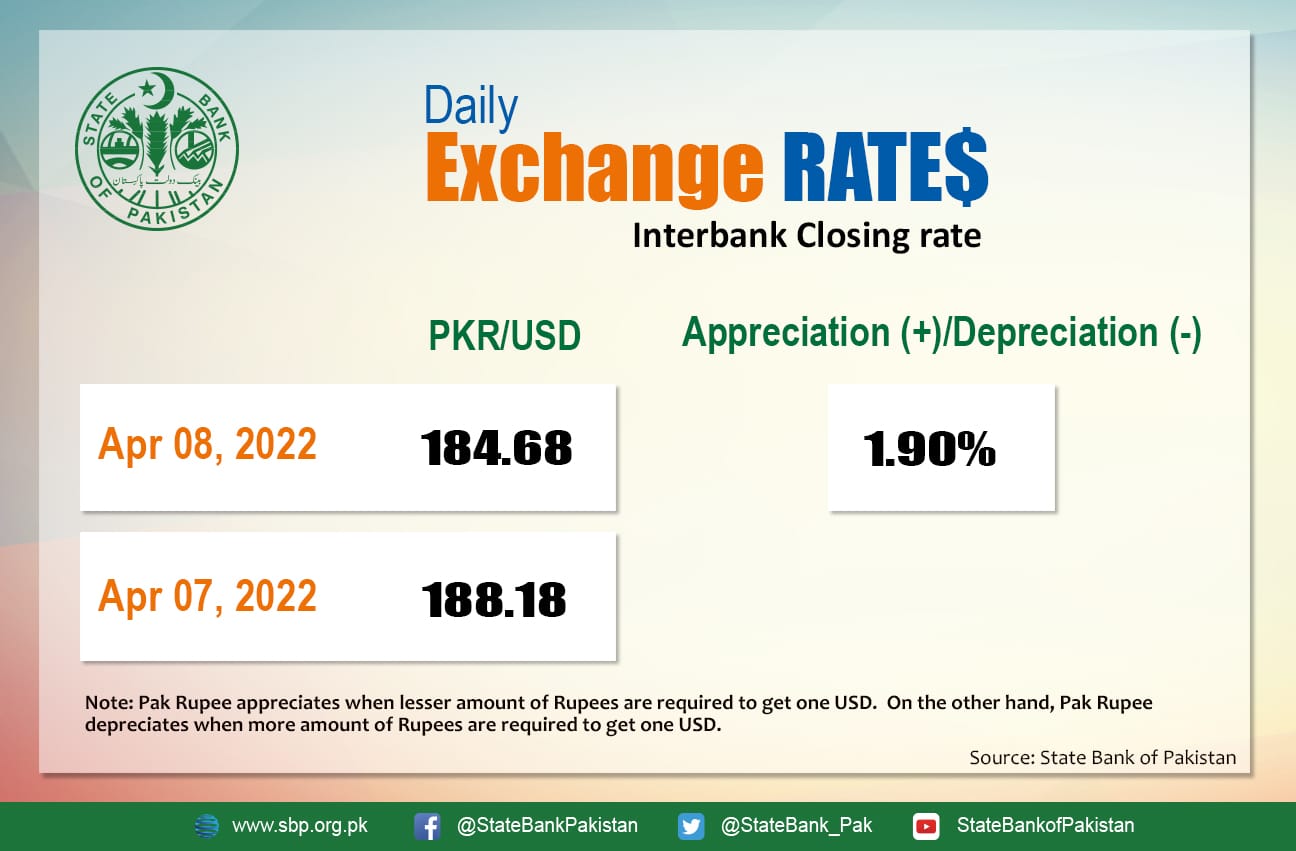

On Thursday, the rupee concluded at Rs188.18 against the USD in the interbank market.

Consequently, the Pakistan Stock Exchange’s (PSX) benchmark KSE-100 index, reversed its downtrend shortly after starting on Friday and surpassed the 44,000 mark, a day after the Supreme Court of Pakistan annulled the deputy speaker’s decision against a no-confidence motion.

Considering the trading which continued at 44, 198 on the Pakistan Stock Exchange, the KSE-100 benchmark index gained 411 points.

The stock market has been under pressure since April 4, when it crumbled, losing over 900 points amid Pakistan’s ongoing political crisis, which arose after the National Assembly deputy speaker declared Prime Minister Imran Khan’s no-confidence resolution unconstitutional.

SBP’s rate increase of 250 basis points and establishment of cash margins on 177 commodities is a marker that the economic system is in a slump and that prior initiatives were inadequate. This protective approach will aid in limiting the import of certain products, consequently bolstering the balance of payments.