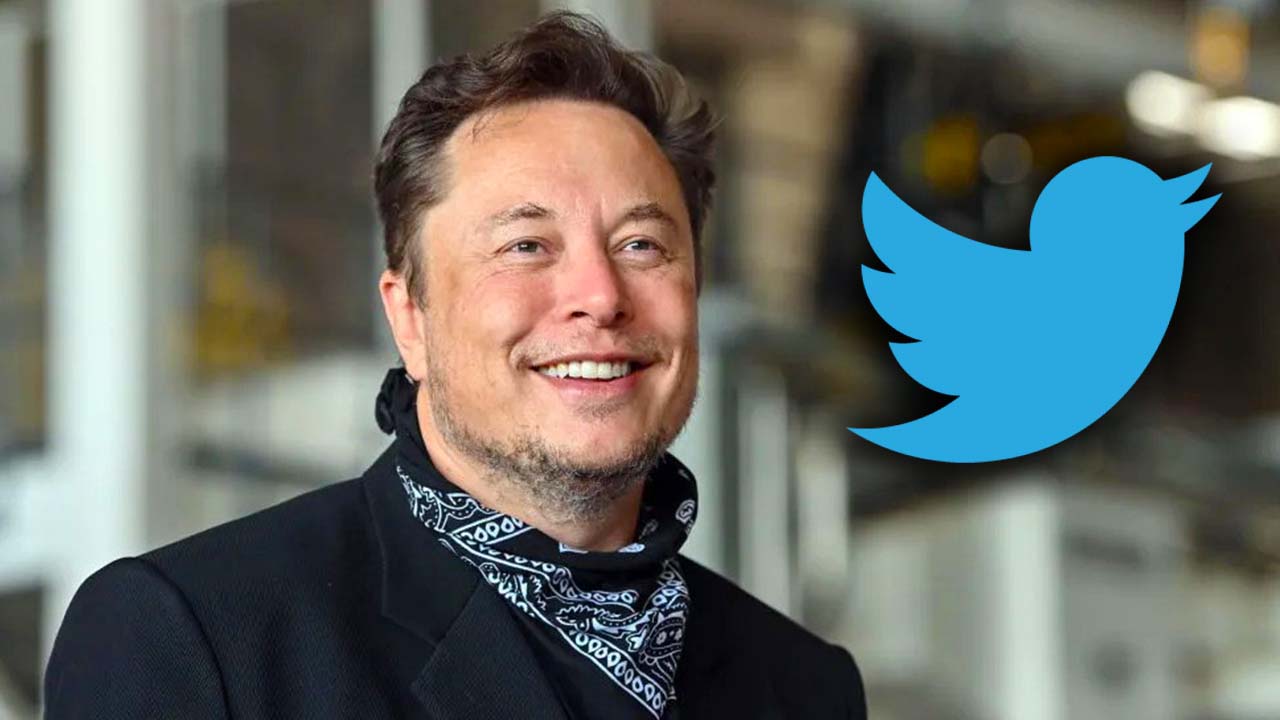

The social media company’s latest quarterly earnings figures offered a glimpse into how the social media business performed during months-long negotiation with billionaire and Tesla CEO Elon Musk over whether he will take over the company.

The company lost $270 million in the April-June period after revenue slipped 1 per cent to $1.18 billion, reflecting advertising industry headwinds, as well as uncertainty over Musk’s acquisition bid.

The number of daily active users rose 16.6 per cent to 237.8 million compared with the same period a year before.

Twitter chalked up the gains to “ongoing product improvements and global conversation around current events.”

Twitter’s legal battle with Musk to fulfil his April promise to purchase the company for $44 billion has overshadowed its most recent sales figures. To close the deal, Twitter last week sued Musk, and now the two parties are preparing for a trial in October.

Twitter announced that it wouldn’t hold its customary quarterly earnings conference call or publish a shareholder letter due to the impending acquisition.

Beginning with the April 4 disclosure that Musk had purchased a sizable stake in the company, opening the door for his takeover bid later that month, Twitter experienced a turbulent three months during the April-June fiscal quarter. Shortly after Musk publicly tweeted his concerns about Twitter and its employees and gave the impression that he was reconsidering his position, the relationship quickly grew strained.

Musk’s actions and his “repeated disparagement of Twitter and its personnel,” according to Twitter, created uncertainty that was bad for the company’s operations, staff, and stock price.

Musk wanted to wait until next year due to the complexity of the case and his demands for more of Twitter’s internal data about how it counts fake and automated “spam bot” accounts, which he’s cited as a key reason for trying to terminate the deal. It called for an expedited trial so the company could continue with important business decisions.

Before the opening bell on Friday, shares were reduced by 2 per cent.

The trial was postponed this week by the judge, who agreed with Twitter that too much delay could harm the company irreparably. Unless Musk and Twitter resolve the case prior to that time, it will be heard in Delaware’s Court of Chancery, which hears numerous high-profile business disputes.

On Friday, Elon Musk retaliated against Twitter for partially attributing its second-quarter revenue shortfall to the uncertainty surrounding the pending $44 billion acquisition of the Tesla CEO by the social media behemoth.

“I’m rubber, they’re glue,” Musk tweeted.

I’m rubber, they’re glue

— Elon Musk (@elonmusk) July 22, 2022

According to Musk, Twitter is “in material breach of multiple provisions” of the agreement and “appears to have made false and misleading representations” when it accepted Musk’s acquisition offer on April 25.

Musk announced last month that he would be terminating the agreement. Musk disputes Twitter’s internal estimates that less than 5 per cent of its users are made up of spam and fake accounts.