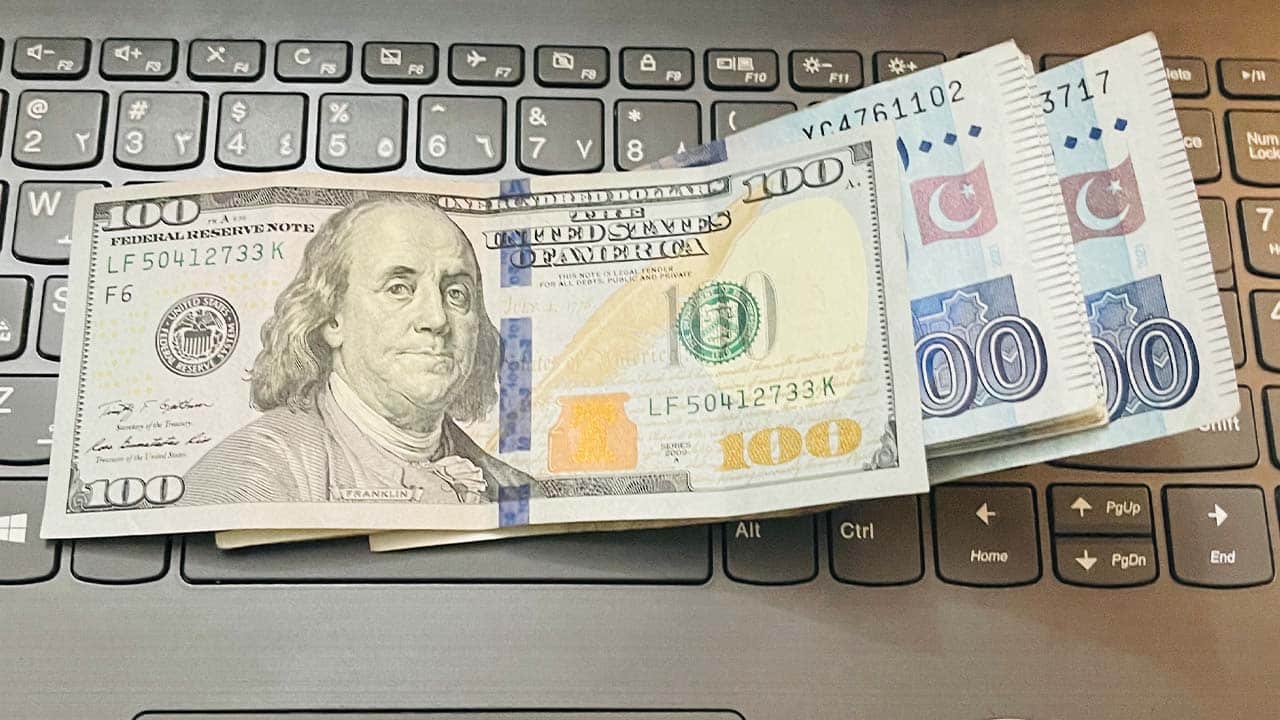

In the inter-bank market, the Pakistani rupee continued its positive trend against the US dollar for the ninth consecutive session on Monday, appreciating by 0.04 per cent to settle at Rs280.24, reflecting a gain of Re0.12, according to the State Bank of Pakistan (SBP).

During the preceding week, the Pakistani rupee sustained its upward movement, appreciating by Rs1.04 or 0.37 per cent against the US dollar, settling at 280.36 in the inter-bank market.

This surge in value is attributed to the recent announcement of a staff-level agreement (SLA) between Pakistan and the International Monetary Fund (IMF) on the first review of the $3 billion Stand-by Arrangement (SBA). Consequently, the approval of the second tranche of the package ensued.

The IMF Executive Board completed the first review of the SBA last week, facilitating an immediate disbursement of $700 million.

As of January 5, the foreign exchange reserves held by the State Bank of Pakistan amount to $8.15 billion, with expectations of further augmentation through IMF inflows.

On the global front, the US dollar experienced a decline on Monday amid renewed anticipations of a Federal Reserve rate cut in March.

Simultaneously, the Chinese yuan faced challenges, hovering near a one-month low ahead of forthcoming economic data releases.

The likelihood of a Fed cut in March gained traction following unexpected December data indicating a decline in US producer prices, prompting a slide in US Treasury yields. The US dollar index remained stable at 102.50, exhibiting minimal fluctuations in recent sessions.

In the realm of oil prices, a significant indicator of currency parity, a slight uptick was observed on Monday. This movement was influenced by concerns over potential supply disruptions in the Middle East, following strikes by US and British forces aimed at preventing Houthi militia in Yemen from attacking ships in the Red Sea.